As you might have heard in the news, last Friday, March 10, 2023, Silicon Valley Bank (SVB) has collapsed and was ordered by regulators to shut down its business. Part of the reasons that its collapse caused great concern is that it is the biggest bank failure since the 2008 Financial Crisis.

The failure of SVB is caused by a classic bank run. SVB had cash deposits of many startup companies. As bad news about SVB started spreading, a large number of these companies along with other depositors scrambled to pull their money out of the bank at the same time. This created a bank run that doomed SVB.

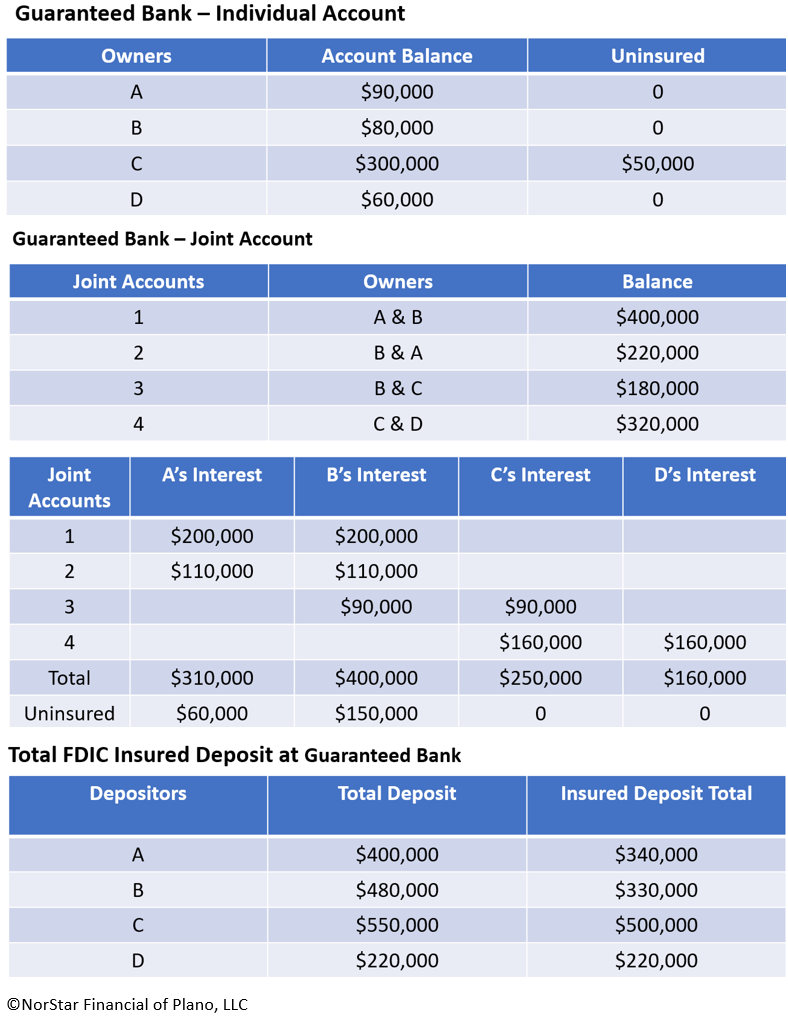

Naturally, you may wonder is my money safe in my bank?The Federal Deposit Insurance Corporation (FDIC) insures depositor accounts in banks and most types of nonbank thrift institutions up to $250,000. Deposits maintained in different categories of legal ownership, i.e. individual, joint account, irrevocable trust, and testamentary account are separately insured. As a result, a depositor can have more than $250,000 insurance coverage in a single institution. Here is how it works:

Likewise, the FDIC insures your deposits in each different institution in the same fashion as illustrated above. So, if you have $250,000 of deposit at each of four different banks, the FDIC insures a total of $1,000,000 of your deposits. As you can see, if you have a large sum of deposit exceeding $250,000, you need to either deposit the money into different types of accounts at the same bank, or spread the deposit among several banks.